If you have a question about your ID Resolve membership, or you’re in need of other support, we’ve got you covered.

Be prepared to invest hours on top of hours in phone calls. Follow up letters to document your calls. Monitoring accounts. Talking to banks, loan companies, credit card companies, the Social Security Administration, and credit bureaus. Maybe even filing reports with the police. Or … you could avoid all those headaches by putting ID Resolve on your case. They know who to call. What paperwork to file. And exactly what is needed to stop identity thieves in their tracks. And they’ll keep you informed with regular updates all along the way.

Older adults tend to be more trusting, and less familiar with common scams – making them a more frequent victim of identity theft. Seniors account for 35% of all fraud complaints each year*. *FTC, 2017

Absolutely. Once they have information like your Social Security number, they can begin creating documents like false driver’s licenses that can help them open accounts or apply for loans in your name.

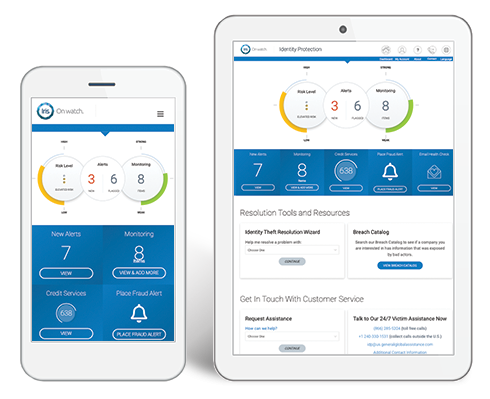

With the growing threat of identity fraud, it’s important to make sure that your credit is closely watched. ID Resolve 360 makes this monitoring effort easier than ever.